Why eCommerce Sellers Need an Edge Now More Than Ever

Estimated Reading Time: 5 Minutes

Before you roll your eyes at yet another "AI will save ecommerce" take - I get it. Everyone's talking about AI being essential for eCommerce. But after implementing data science-driven systems at eCommerce giants for a combined 75 years, this isn’t another blog post encouraging you to get swept up in the hype. It’s about why now is the time to use new tools to better implement the basics. Let’s get to it:

Back in 2016, I landed at Wayfair as the company was solidly in its golden era. Though the time was not without its issues, the numbers were intoxicating: 50%, 60%+ growth rates quarter after quarter. Then, during the pandemic, growth exploded. Those were the days when ecommerce felt unstoppable.

Today, that broader eCommerce euphoria has faded, replaced by a grinding reality that's forcing online sellers to confront an uncomfortable truth: the easy money is gone, and what's left requires a level of sophistication most businesses simply don't yet have.

The Great Slowdown

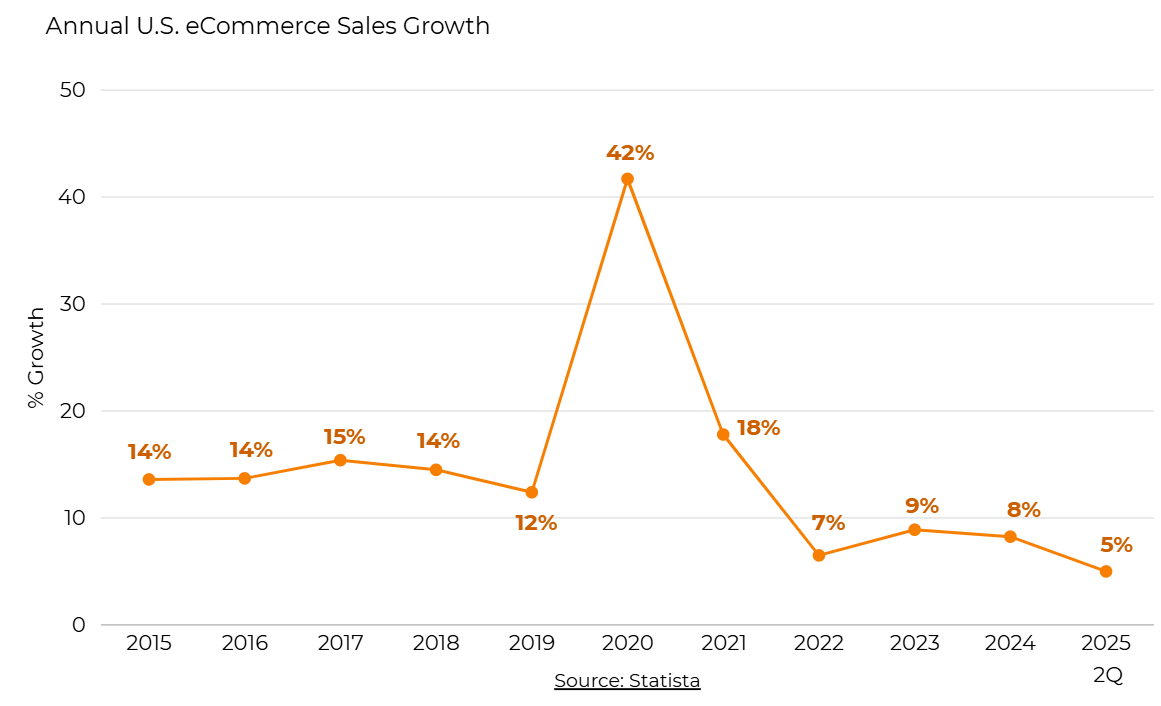

Online sales growth has not returned to pre-pandemic levels

The data tells a story that anyone who operates online lives and feels every day. U.S. ecommerce growth, which was growing at a clip of ~14-15% and then peaked at dramatically higher than that in 2020, has plummeted to the single digits, and just 5.3% in the second quarter of 2025. That's the slowest growth rate since late 2022. For context, this means ecommerce is now growing only slightly faster than traditional retail sales.

The implication? The rising tide that previously lifted all boats now presents closer to a zero sum growth game.

The Path to Success is Increasingly Narrow

Amazon has built a marketplace offering sellers extensive capabilities, but these tools come with costs that have steadily increased over time. For example, while referral fees (the percentage commission on each sale) have stayed largely consistent, FBA fulfillment fees have risen nearly twofold for standard-size items since 2021. In response, more than 64% of sellers told SmartScout in a survey that they adapted by raising prices in 2024, keeping pace in a dynamic environment where total fees now often exceed half of gross revenues.

So, to become and stay profitable against this backdrop, sellers must manage inventory, advertising optimization, pricing strategy, compliance monitoring, and customer service, often simultaneously across hundreds or thousands of products.

The Technology Imperative

This brings us to the most critical shift happening right now: data science and artificial intelligence have moved from competitive advantage to operational necessity. According to a 2024 survey by Precedence Research, the global AI in eCommerce market is projected to grow from ~$7 billion in 2024 to ~$64 billion by 2034, a 24% annual growth rate that signals not an emerging opportunity but an existential requirement.

Leading retailers are automating customer service, personalizing product recommendations, and even generating SEO-optimized content at scale.

AI and ML can now be used to predict demand with unprecedented accuracy, optimize pricing in real-time, and manage inventory across complex supply chains. For sellers still relying on manual processes and intuition, this isn't just a disadvantage, it's a death sentence in slow motion.

Businesses must adapt. Those who survived the initial post-pandemic slowdown now find themselves in a permanently more demanding competitive environment where success requires capabilities they've never had to develop.

The Time is Now: A New Competitive Tier Emerges

For online sellers, especially those operating on Amazon, the message is clear: the window for building competitive advantages through advanced technology and operational excellence is open.

And here’s a prediction: What makes this moment so critical is that we will witness the emergence of a new competitive tier in ecommerce. The businesses that invest now in AI-driven automation, sophisticated analytics, and integrated operational systems will pull away from the pack. Meanwhile, those still operating with legacy approaches (manual bid management, spreadsheet-based inventory planning, intuitive pricing strategies) will be systematically squeezed out.

How Lighthouse Changes the Game for Online Sellers

We are offering a different path.

While most sellers are still wrestling with disconnected tools and manual processes, Lighthouse operates fundamentally differently. Instead of using separate systems for pricing, advertising, inventory, and forecasting, each making decisions in isolation, our platform treats these as interconnected pieces of a single puzzle - what we can “joint optimization”. When inventory runs low on a top-performing product, we don’t just send an alert; we automatically adjust advertising spend to preserve margin, update pricing to reflect scarcity, and recalibrate forecasts based on real-time demand signals. When a competitor drops their price, we don't just match it blindly; our platform evaluates the profit impact, considers your current inventory levels, adjusts ad bids accordingly, and determines whether to compete on price or shift budget to higher-margin products. This is what "joint optimization" actually looks like in practice: one brain managing all the levers simultaneously, making thousands of coordinated decisions that manual processes simply cannot match.

This isn't about adding another tool to your existing stack; it's about reimagining how ecommerce operations work in an environment where manual processes have become a liability rather than an asset. The successful sellers of 2030 will look nothing like the successful sellers of 2020, and that transformation is already underway.

Closing

The golden age of rising eCommerce tides is over. What's emerging in its place demands more sophistication, data and technology than ever before. An edge isn't just nice to have anymore, it's the price of admission.